The “More Housing law” stipulates that the extraordinary contribution on local accommodation (CEAL) is a fixed rate of 15%, to be applied to a variable taxable base dependent on various factors.

The taxable base on which the 15% CEAL is levied is calculated by combining three factors: the economic coefficient of local accommodation, the urbanistic pressure coefficient on the gross private area of the property applied to the gross area of the local accommodation.

In very simple terms, this tax is calculated as follows:

A rate of 35% is applied to the number of square meters of the property designated for local accommodation (AL), and this number is multiplied by two coefficients – the economic coefficient of AL and the urbanistic pressure coefficient.

Let’s start with the first coefficient, the economic coefficient of AL:

This corresponds to the quotient between the average annual income per available room (RevPAR) in local accommodation, as determined by the National Institute of Statistics, and the minimum gross area of a residential property of type T1, according to the General Regulation of Urban Buildings, which is 52 m2.

As for the second coefficient,

The urbanistic pressure coefficient is a bit more complex and corresponds to the quotient between the positive variation of the reference rent per square meter between 2015 and the previous year, and the positive variation of the reference rent per square meter in the area where this variation is highest nationally. This reference rent, in general terms, is the median rent per square meter of permanent residential lease contracts, communicated through the Stamp Duty model 2.

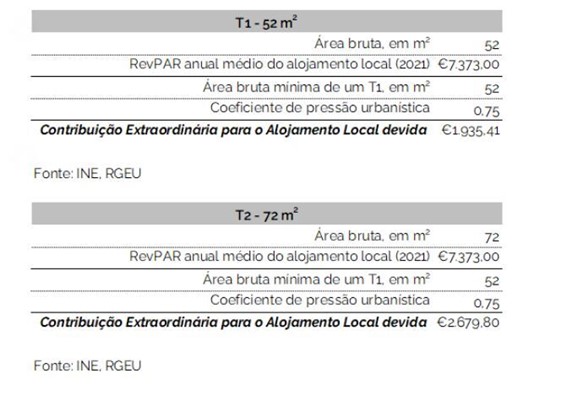

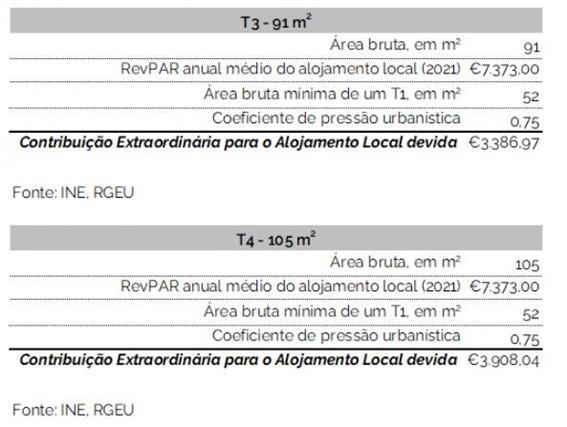

As an example, I present below some simulations of the Extraordinary Contribution on Local Accommodation that will be due, under this current formulation, assuming an urbanistic pressure coefficient of 0.75, meaning that the positive variation of the reference rent in the area where the AL is located between 2015 and the previous year corresponds to 75% of the maximum variation of the reference rent observed nationally.

On the next page, we present some examples.

As explained, CEAL does not factor in the income generated by local accommodation activity in its calculations. Instead, the law opted for the use of the economic coefficient for local accommodation, utilizing the average earned by local accommodations throughout the national territory (the value to be determined by INE each year).

This means that the final amount due will be the same, even in situations where the earned income is very different because the calculation base is the same for everyone. In other words, two local accommodations with very different availability (one available for rent for two months, another available all year round) and thus with very different incomes, will pay the same tax amount because, for CEAL, the national average is used.

In the relevant clause (clause a) of Article 6 of the annex to Article 22 of Law No. 56/2023, of October 6th, the “More Housing law”), it is stated: “The average annual income per available room in local accommodation determined by the National Institute of Statistics, I.P., for the year preceding the tax event.”

For this reason, the rate disregards individual actual contributive capacity and is based on a “presumption of income” principle, with owners being taxed for what they are presumed to have earned through this generalization of incomes, rather than what they actually earned in the tax year in question.

Are all local accommodations required to pay CEAL?

Despite its generic name, CEAL will not be applied to all local accommodations with a valid license, and exceptions are based on the location of the local accommodation, its typology, and even its use throughout the year. Let’s explain.

Local accommodations required to pay CEAL:

The extraordinary contribution on local accommodation (CEAL) applies to local accommodations whose activity is carried out in residential properties, especially autonomous fractions or parts of urban buildings capable of independent use—especially in coastal areas (with some exceptions), as explained below.

CEAL will also apply to all local accommodations that meet the legal requirements throughout the Portuguese territory, including the autonomous regions of the Azores and Madeira.

Properties located in interior territories (as identified by the Government in the annex to Ordinance No. 208/2017) and those in other territories without housing shortages defined annually by Municipalities will not be subject to CEAL.

The prerequisite for applying CEAL is the existence of a valid local accommodation license on December 31 of each calendar year, so that the property assigned to local accommodation is subject to payment of this contribution in the following year.

We also remind you that, according to the other measures of “More Housing law” for local accommodation, licenses will automatically expire if the property does not prove the maintenance of local accommodation activity. Local accommodations exempt from paying CEAL:

Local accommodations in interior territories:

The “More Housing law” granted several exceptions to a set of locations in interior territories so that they can continue to be revitalized through tourism activity. Although not all territories are free from restrictions for new licenses, all local accommodations located in interior territories are exempt from paying CEAL.

Local accommodations operating in wholly-owned buildings:

Local accommodations with a license that are not located in horizontal or vertically-owned urban buildings with divisions capable of independent use are exempt from paying the extraordinary contribution on local accommodation.

In other words, houses will not pay CEAL, including houses with lodging establishments.

Local accommodations in room mode:

Local accommodation licenses can also be granted in the “room” mode. These differ from lodging establishments, including hostels, by being registered at the tax residence of the AL license holder and cannot exceed 3 rooms per property. These room mode local accommodations are also exempt from paying the extraordinary contribution.

Local accommodations registered in the owner’s own and permanent residence:

Local accommodations with licenses registered at the same location as the owner’s own and permanent residence are also exempt from paying CEAL if the operation does not exceed 120 days per year.

Local accommodations registered in properties intended for non-residential uses:

Additionally, local accommodations operating in properties whose constitutive title does not designate them for residential use are also exempt from paying this extraordinary contribution on local accommodation (such as services, as is the case with properties intended for commercial use, which the municipality of Porto allowed to be converted into local accommodations in its local accommodation regulations).

Possible exemptions:

Local accommodations in low housing pressure parishes:

When we talk about exemptions based on geographical location, in addition to interior territories, parishes are also exempt from paying the extraordinary contribution if, in a given year, they simultaneously meet all the requirements below:

Fit into municipalities whose Housing Municipal Charter demonstrates a good balance of housing and student accommodation in the municipality;

Are part of municipalities that have not declared housing shortages;

Do not have part of their territory as an urban pressure zone.

Note that, since this definition only occurs after the year in which AL activity has also been developed, it is not possible to know in advance based on these criteria whether CEAL will have to be paid for a given year or not.

Who has to pay CEAL?

All non-exempt local accommodations with a valid license on December 31 of this year will start paying CEAL annually.

The debtor of CEAL will always be the holder of the local accommodation license. However, if this person does not pay, and if the property owner is not also the license holder, the owner will be subsidiarily responsible for this debt.

When and how is CEAL paid?

The tax will be due annually, and for this, the government will have to provide an official model for CEAL declaration, which must be filled out and submitted by the license holder.

The deadline for submitting this declaration to the Tax Authority ends on June 20 of the year following the one to which CEAL applies, and the respective amount must be paid by June 25.

Source Dinheiro Vivo and ALEP