Simplified Layoff 2021

(Extraordinary measure to support the maintenance of labor contracts)

Given the evolution of the epidemiological situation in Portugal, in the context of the Covid -19 pandemic, the government decided to adopt a more restrictive set of measures, having also adapted the support mechanisms for workers and companies according to the economic and social effects emerging from the worsening situation.

Who it applies to

It is intended at employers, who are subject to the duty of closing facilities and establishments by legislative or administrative determination of a governmental source, in the context of the Covid-19 pandemic.

Employers may access support as long as their activity is totally or partially subject to the duty of closure, being covered the workers affected by this duty of closure.

Note: Lay-Off can be triggered by total suspension of the employment contract or by reducing the number of hours worked.

What is support

The employer has the right to a financial support for each worker, granted to the company and destined exclusively for the payment of the remuneration.

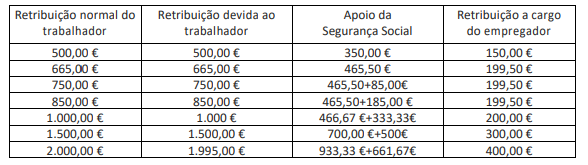

The employee has the right to a support corresponding to 100% of his gross normal remuneration, or the value of RMMG (665€) corresponding to his normal working period, with the limit of 3 RMMG (1,995€).

The compensation corresponding to 2/3 of your gross normal remuneration, or the value of RMMG corresponding to your normal period of work, not exceeding 3 RMMG. The social security supports 70% of this amount and the employer the other 30%.

The compensation is also increased to the absolutely necessary to ensure the employee’s gross normal remuneration up to a maximum of 3RMMG, with the Social Security supporting this amount.

Example 1: if an employee in a normal situation receives a gross salary of 1.200€, he has the right to receive 1.200,00€. The employer supports 30% of 2/3 of that amount (240€) and the social security supports 70% of 2/3 of 1.200€ and the remainder until they complete 1.200€ (560,00€+400.00€).

Example 2: an employee with a monthly remuneration of 1,200€ and a 50% reduction of the normal working period has the right to receive 600€ of remuneration for working hours.

He has also the right to receive a compensation payment of 600€. The employer supports 60€, which corresponds to 30% of 200€ (2/3 of 1,200€ less the 600€ of the period worked) which together with the remuneration of 600€ for the working hours makes up 2/3 of the gross normal remuneration, and the social security supports 140€, which corresponds to 70% of 200€, more 400€ of additional compensation.

In other words, the employer supports 600€ for the hours worked and 60€ of compensation and the social security supports 540€ euros of compensation.

Exemption from payment of contributions associated with layoff

This measure provides for temporary exemption from the payment of social security contributions by the employer.

In this context, employers are entitled to exemption from the payment of social security contributions in respect of workers covered by the provisions of decree-law 10-G/2020 and members of statutory bodies, for the duration of the support.

The exemption refers to the employer’s contributions in respect of the total remuneration paid to the workers covered by the extraordinary support for the maintenance of the employment contract, maintaining the contribution of 11% for the worker and the member of the statutory body.

Independent workers who are employers, and their spouses, are also entitled to the temporary exemption of social security contributions, maintaining the obligation to submit the quarterly declaration, when subject to this obligation.

Accumulation with other supports and social security benefits?

If you have already submitted the request for extraordinary support for the resumption for the month of January, and you want to submit the request for a simplified layoff still for january, you must register a withdrawal of the extraordinary support for the resumption from the day you want to join the simplified layoff. For example, entities that want to join the simplified set-up as of january 15 must register a withdrawal from the extraordinary takeover support as of january 15.

It cannot be accumulated with the extraordinary support for the take-back, with the support for the reduction of activity and with benefits from the social security system (sickness, parenting and unemployment).

How long is the support

This support has an initial duration of up to one month, and can be extended monthly, as long as the duty of closure is maintained.

The extension of the extraordinary support is requested monthly in its own model, delivered through the direct social security, and accompanied by the respective annex with identification of the workers covered by the extension. The instructions for the extension will be available on the social security website.

The extension request must only be delivered after the initial request is granted.

What is not allowed to the employer while receiving financial support?

A) Dismissal, except for a fact imputable to the worker;

B) Non-compliance with the retributive obligations due to the workers in a timely manner;

C) Non-compliance with their legal, fiscal or contributory obligations;

D) Distribution of benefits to the partners and shareholders, during the validity of the obligations arising from the granting of the incentive, in any form, namely as a withdrawal on account;

E) Failure, imputable to the employer, to fulfill the obligations assumed, within the established deadlines;

F) Making false declarations;

G) Provision of work to the employer itself by each worker covered by the extraordinary support measure for the maintenance of an employment contract in the form of contract suspension, or beyond the established time, in the form of temporary reduction of the normal work period.

You can get more information at the following links: